Freeport-McMoRan still waiting for US copper tariff details, CEO says

Freeport-McMoRan has yet to see details of US President Donald Trump's plan to impose a 50% tariff on copper imports starting next week, its CEO said on Wednesday after the mining company posted better-than-expected quarterly results.

Trump announced the tariffs earlier this month as part of a plan to boost US production of a metal critical to electric vehicles, military hardware, the power grid and many consumer goods.

The duty is slated to begin on August 1. The US imports roughly half of its annual copper needs.

Trump and his administration have not shared details on what type of the red metal the tariff would affect, a lack of clarity that has confounded producers, companies that use copper and countries that export it.

"We're still waiting on additional details on implementation of the tariff announcement," Freeport CEO Kathleen Quirk told investors on a conference call on Wednesday.

Quirk added that Freeport is "not aware of any exemptions at this point" for US imports of the metal.

Responsible for 70% of refined US copper - the country's largest producer - Phoenix-based Freeport would be the biggest beneficiary of any copper tariff, with a boost to annual profit of at least $1.6-billion, Reuters reported earlier this month.

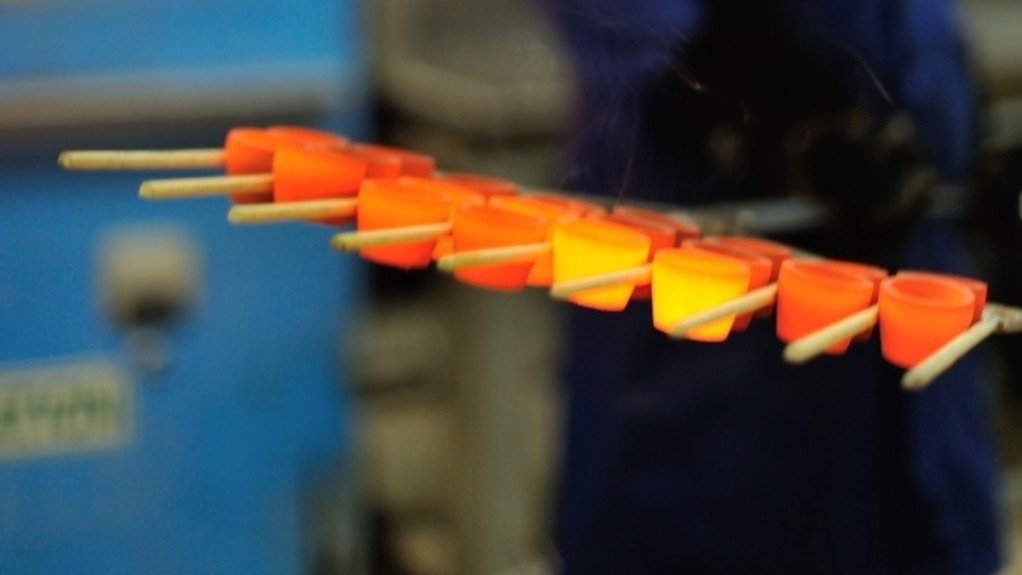

Freeport also produces copper in Chile, Peru and Indonesia, where it operates the Grasberg mine - the world's second-largest copper mine - and a smelter.

While Freeport traditionally has sold its Indonesian copper to Asian customers, Quirk said the company would consider shipping some supply to the United States.

"We do have flexibility to send it to the place that makes the most sense," she said. "We don't have long-term contracts locked up" for Indonesian copper.

Freeport operates one of two US copper smelters and has been studying whether to expand its capacity by roughly 30%, Quirk said, adding that the company has not discussed the plans with the Trump administration and that it has no desire to build a new US smelter.

US copper prices have gained more than 25% since Trump announced the tariffs. When asked whether the increase could affect copper demand, Freeport executives said they continued to see strong demand but longer-term saw the issue tied to how the tariff is implemented.

"Ultimately, it's going to be global supply and demand that will end up driving (prices), and then whatever tariffs are there, how they're absorbed and where they're absorbed in the US marketplace," said Freeport's chairman, Richard Adkerson.

Adkerson added that Freeport has lobbied Washington to streamline the mine-permitting process to boost the country's copper output.

RESULTS

For the second quarter, Freeport's profit beat Wall Street's estimates as higher copper and gold prices offset lower production.

The company reported an adjusted profit of 54 cents per share for the three months ended June 30, compared with analysts' average estimate of 45 cents, according to data compiled by LSEG.

The company's shares were down about 1.5% at $45.09 on Wednesday afternoon.

Freeport said it expects to sell 1.3-billion pounds from its domestic mines in 2025.

The company warned of a roughly 5% increase in the cost of its US purchases if suppliers pass along tariff-related expenses for other materials.

The company's quarterly average realized price for copper was $4.54 per pound, up 1.3% from a year earlier, while its average realized price for gold was $3 291 per ounce, up about 43%.

However, second-quarter copper production dropped around 7% from a year earlier to 963-million recoverable pounds.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation